May Highlights

-

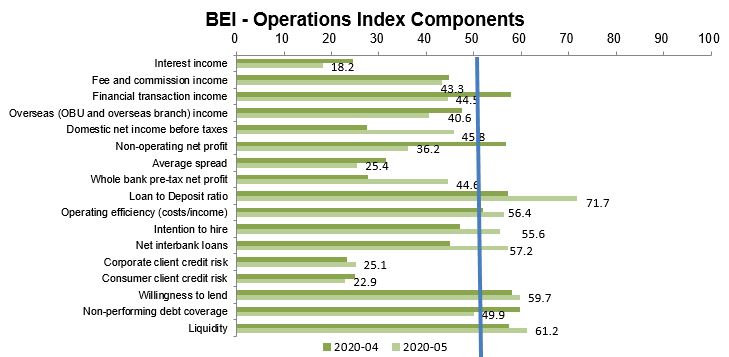

After international re-opening, worries deepen over second wave; Operations Index improved but remained under 50

The BEI Operations Index diverged from the rebounding Market Index. The main sub-indices including domestic interest income, transaction fees, financial transaction income, and OBU and overseas income all fell, the first time since the creation of the BEI that all four have scored under 50 at the same time, indicating that bankers anticipate a significant impact from negative changes in the operating environment. Bankers forecast that non-operating profit, interest income, financial transaction income, spreads, and NPL rates will all be affected over the next three months. After Hong Kong implements its security law in the second half of the year, US-China relations and overall confidence may become unstable in the short term in response to political and economic risks, indicating that Hong Kong branches may continue to reduce their exposure. Returning to above 50 would depend on economic performance in the US and China.

-

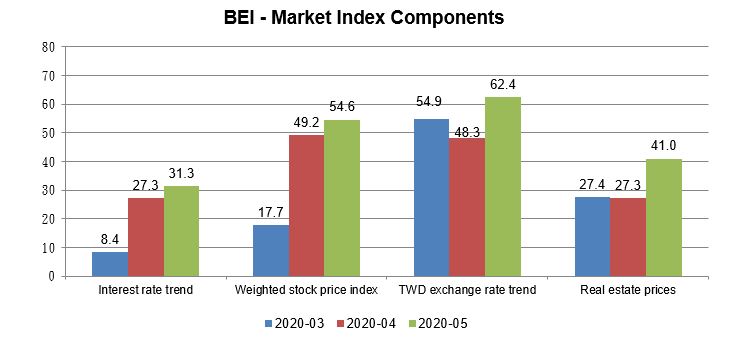

Views on the markets improved, Market Index rebounded but still below 50

Due to the global market stabilization, plus the Fed’s projection that the federal funds target range will remain from 0%-0.25%, there is little chance of negative rates. Bankers’ views on interest and exchange rates and stock and real estate markets all improved from last month. Stocks and foreign exchange rose above 50. The NTD is up against the USD; the real estate market had a strong rebound. Overall market projections over the next three months remain below 50, indicating that bankers believe global market volatility will increase, and are pessimistic about financial market performance.

-

Domestic and international political and economic focus points this month

1. The impact of the COVID-19 pandemic on the global economy; 2. Oil price volatility; 3. Loose monetary policies; 4. Bailouts in response to the pandemic; 5. The FSC’s strengthened management of insurance policies and its impact on domestic wealth management; 6. The international impact of the US WHO withdrawal; and 7. The US cancellation of Hong Kong’s special trading status and the impact on global economy and trade.

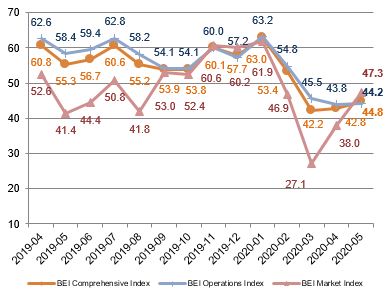

BEI Trends

The May 2020 BEI Comprehensive Index scored 44.8, up 4.67% from the 42.8 in April. The Operations Index scored 44.2, up 0.91% from April’s 43.8. On 5/29, the Central Bank noted that the pandemic poses four threats to the global economy: economic recession, financial market volatility, an explosion in government debt, and increasing risks in China. Global economic growth has slowed significantly, risks have increased, and Taiwan’s growth has also been hit. According to the latest Central Bank statistics, domestic banks’ bad debt coverage allowance fell from 651.78% at the end of last year to 569.83% in March, causing banks to lend more conservatively. Bankers expect non-operating profits, interest income, financial transaction income, spreads, and bad debt coverage to be affected, and the Operations Index remained below 50.

The Market Index scored 47.3, up 24.47% from the 38.0 in April. Bankers’ views on the markets improved, but still remained below 50. The COVID-19 pandemic has seriously affected the economy, which bankers expect to affect corporate and personal creditworthiness. Views on real estate improved but remained low, scoring 41.0. The US cut interest rates to near zero, but Taiwan’s rate cuts were smaller. Bankers’ views on interest rate trends rebounded but remained low at 31.3. Views were optimistic on Asian exchange rates, and emerging markets are expected to appreciate against the NTD; the exchange rate index scored 62.4. No new domestic COVID-19 cases have occurred for six weeks, and the situation is better than in most other countries, improving investor confidence. Bankers are optimistic about the stock market, which increased its score to 54.6, but with uncertainty about US-China relations and oil prices, the overall Market index remained below 50, indicating that bankers expect further market volatility over the next three months.

BEI - Market Index Components

BEI - Operations Index Components

Changes since last month

| Rank |

Best performing indicators |

Worst performing indicators |

| 1 |

Domestic net income before taxes |

Non-operating net profit |

| 2 |

Whole bank pre-tax net profit |

Interest income |

| 3 |

Net interbank loans |

Financial transaction income |

| 4 |

Loan to deposit ratio |

Average spread |

| 5 |

Intention to hire |

Non-performing debt coverage |