【May TAIFRI Highlights】

-

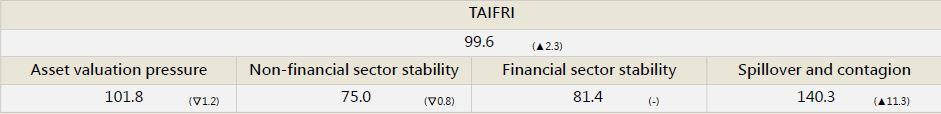

TAIFRI index scored 99.6 in May, up 2.3 from April

-

Real estate market risk has moderated

The rise of cases and real estate speculation policies have caused a slowdown in real estate transactions, which restrained the increase in housing prices, while rents rose steadily with inflation. In April, the rent index of the Ministry of the Interior hit a 41-year high. DGBAS has lowered its estimate of Taiwan’s economic growth, and the future trend of rents remains to be seen.

Risks in overseas markets rise

The Fed raised interest rates by 50 basis points in May, and the VIX climbed to its highest level since November 2020. CDS in the US, China, Japan and Europe also rose sharply in May to the level of 2020Q2; overseas markets were the most significant component of the risk increase in May. The domestic financial contagion effect has grown for three months, hitting a high since October 2021.

-

High-yield bond investment holdings continued to decline

Investment in overseas high-yield bond funds has declined for four months, reducing household sector risk. In the business sector, the BBB-rated corporate bond rate rose 0.2% to 1.9%, while 10-year Treasuries fell 0.1% to 1.2%, widening the spread between the two to a 9-month high. Corporate borrowing costs and debt risks are rising, but bank lending to corporates still grew around 8-9% YoY, with strong momentum.

* TAIFRI changes base period to February 2017, equal weight for the four pillars and removes normalization for the components from May 2022.

--For the complete content, please download the file below