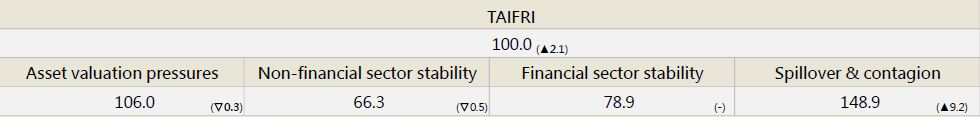

【October TAIFRI Highlights】

-

October TAIFRI score reached 100.0, up 2.1 from September

-

Stock market volatility risk remains high

Taiwan P/E ratio was 9.3x the initial estimate, falling below double digits for two months in a row. The Taiwan VIX fell slightly, but it was still the second highest since March 2021, showing continued volatility risk. In real estate, residential rents have risen, but at a slower rate; sales prices have not changed significantly. Annual growth of commercial office rents in 3Q hit a nearly year-long high, and annual growth of prices hit a high since 2015, which should not be affected by short-term changes.

-

Overseas market and credit risk continued to rise

The VIX and credit default swap (CDS) indices in the US, China, Japan, and EU have risen for two months. The VIX in China hit a record high since April 2020, and CDS in Asia ex-Japan hit a nearly decade-long high. Fed tightening has put pressure on Asian currencies, increasing overseas market and credit risks. Domestic contagion risk has fallen for four months, hitting a low for 2022.

-

Banks’ asset quality and corporate lending grew steadily

NPL and bad debt coverage ratios remained stable. Average capital adequacy ratios have remained at 14%-15% the whole year, and capital structure remains sound. Corporate lending has grown at double-digit rates since July, and is not expected to fall.

--For the complete content, please download the file below