【March TAIFRI Highlights】

-

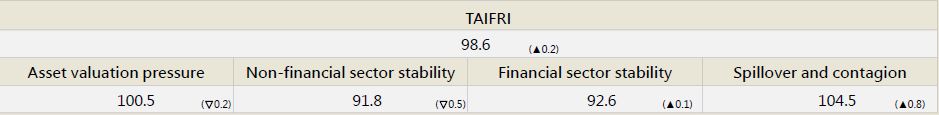

March TAIFRI score was 98.6, up 0.2 from February

-

Stock market risk increased slightly; residential price-to-rent ratio grew

The P/E ratio of the Taiwan stock market rose slightly; yields fell to a low this year due to a significant rise in government bond yields; overall market risk increased slightly. Residential sales prices grew faster than rents, leading to a rise in real estate risks.

-

Significant increase in overseas market risks

The increase in US interest rates increased credit risks in overseas markets. In addition, the Ukraine war and pandemic situation in China increased the VIX index in Europe and China, and overseas market risks reached a new high since July 2020. The domestic spillover index also increased to its highest level since October 2021, and the risk of knock-on effects rose.

-

High-yield bond investment has been reduced; corporate credit expansion slowed

In the household sector, investment in overseas high-yield bond funds has declined for two months, reflecting the impact of rate hikes, and reducing risk in the household sector. Growth in bank corporate lending has slowed since January, but spreads between BBB-rated corporate bonds and government bonds fell to a record low since August 2007 as government yields climbed.

--For the complete content, please download the file below