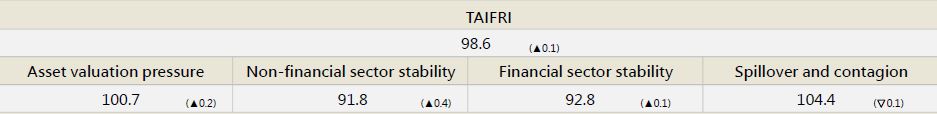

【April TAIFRI Highlights】

-

April TAIFRI score was 98.6, up 0.1 from March

-

Rising risks in commercial office market

After 2014 Q4, commercial rent rose more than sales prices, but this has reversed since 2021Q2, causing commercial real estate market risk to increase. In the residential market, the rise of the pandemic and new speculation policies have slowed transactions, so price increases have been restrained.

-

Increased credit risk in overseas markets and contagion risk in domestic financial markets

The US Fed is expected to raise interest rates in May with a strong consensus, so VIX indices in overseas markets of April fell, but CDS indices in the US and Europe have both risen for five months, reaching new highs since July and June 2020 respectively. The domestic financial market contagion index has risen for two months, reaching a high since October 2021.

-

Reduced risk from overseas high-yield bonds

Investment in overseas high-yield bond funds has declined for three months, reducing household sector risk. Meanwhile, April’s 0.4% spread between BBB-rated corporate bonds and public bonds marked a new low during the TAIFRI compilation period (since August 2007). Growth in lending to corporates decreased slightly from 10% at the beginning of the year to a still-strong 9%.

--For the complete content, please download the file below