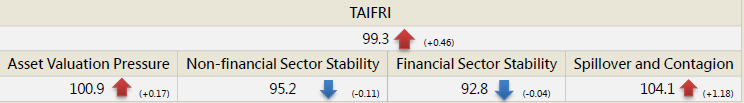

【MAY TAIFRI Highlights】

-

May TAIFRI index scores 99.3, reflecting higher risk

-

Real estate risks have eased, but stock market volatility increased

Due to a new government policy, loan-to-value of new mortgage has slowed in Taipei for two months. In April, mortgages in the five major banks declined and rates rose, indicating that banks are cooperating with the policy. The price -to-rent ratio did not changes significantly in May, real estate market risk remained stable. In equities, following outstanding Q1 performance, the market P/E ratio of Q1 declined, and risk declined, but following the local outbreak, the Taiwan VIX increased by 50% month-on-month, indicating higher asset price volatility risk.

-

The volatility of overseas asset prices increased sharply, and contagion risk among domestic financial institutions rose

The Asia ex. Japan credit default swap index has risen for two months in a row to a 10-month high. In Mid-May, the US stock market fluctuated due to inflation concerns, and the fear index soared 40% in two days. Price volatility in Chinese, Japanese, and European markets also increased significantly, which is the main source of increased risk this month. The contagion risk in domestic financial institutions has grown for two consecutive months.

-

Lower risk in financial and non-financial sectors, but credit risk persists

In the household part of the non-financial sector, investment in overseas high-yield funds has exceeded 10 times that in general funds for two months, but down slightly from the previous month. In the corporate sector, the BBB bond yield has fallen for three months. Due to the bailout loan, corporate funding is expected to remain low-risk. NPL ratios and coverage ratio may however be slightly affected by the pandemic.

--For the complete content, please download the file below