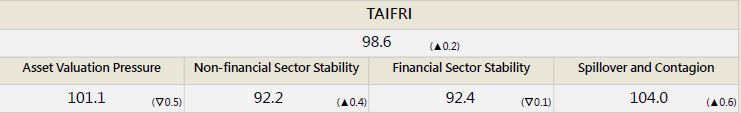

【February TAIFRI Highlights】

-

TAIFRI scored 98.6 in in February, up 0.2 from January

-

Elevated stock market volatility; real estate market risk subdued

The P/E ratio of the stock market has fallen for two months, and price risk has remained stable, but volatility has increased since January, and the VIX was the second highest since 2021/6. In real estate, due to the annual holiday in February, residential transactions cooled slightly, while rents increased significantly, so market risk declined slightly.

-

Expectations of rate hikes have significantly increased overseas credit risk

As the US inflation rate hit a 40-year high in January, expectations of rate hikes have caused a surge in risk hedging, which shows that overseas credit risks have risen. The VIX of overseas markets has also increased for four months.

-

The low-rate environment may end, and transfer to high-yield bond investment accelerates

As rate hikes approach, investment in overseas high-yield bond funds has shifted to general investment-grade bond funds; the ratio between the two has dropped from over 11 to below 9.5 times, reducing risk for the household sector. In the corporate sector, meanwhile, annual growth in bank lending has continued to hit nearly decade-long highs, and spreads between BBB-rated corporate bonds and government bonds have also climbed for two consecutive months.

--For the complete content, please download the file below