2020 Critical Financial Trends: Covidnomics Outlook - Part I2020/04/24

Part I: A Stricken Global Economy

A: Before the Onset: Growth was Already Slowing

After the 2008 global financial crisis, various countries implemented different forms of Quantitative Easing (QE) to stimulate their economies, causing central banks’ balance sheets to greatly expand. In particular, because economic growth slowed, balance sheet tightening or shrinkage schedules were gradually abandoned. Originally intended as a response to the crisis, QE became the new normal. Although excessive money supply can boost markets, real economic growth has gradually declined, causing the two to become unaligned. This has also exacerbated financial vulnerabilities and increased the possibility of a black swan event. The COVID-19 epidemic and the collapse in crude oil prices has put the final nail in this bull market.

The most important global trend since 2008 has been China’s increasing economic power and global role. In particular, in November of that year, facing a sudden freeze in global demand, it implemented a 4 trillion-yuan stimulus package, using leverage to expand the scope of its central and local fiscal policies. In addition to supporting domestic demand through large-scale infrastructure such as railroads, highways, and airports, it boosted various industries and companies with subsidies. China became the rescuer of the world economy. As one indicator of its success, international raw goods prices returned to their pre-crisis levels within one or two years.

Regarding global industry chains, China’s national team became heavily involved in solar panel and LED production with the help of large government subsidies, somewhat like during the early Great Leap Forward years. These production capacity support policies not only met China’s domestic demand, but were also dumped products on world markets due to price competition, forcing many other companies to withdraw. As “made in China” went global, production became increasingly concentrated in China. Eventually, US President Trump slammed China’s subsidies to certain industries as uncompetitive.

The current supply chain crisis caused by work stoppages perfectly illustrates the risks and vulnerabilities created by global dependence on China, after it hollowed out other countries’ manufacturing. This vulnerability includes finance. After the crisis, many countries were unable to retreat from the resulting low-rate environment. After a long period of ineffectual monetary policy failed to stimulate demand as expected, funds were driven to the financial market, causing paper wealth.

After the pandemic spread to Europe and the US, the US Fed cut rates sharply, but markets remained unmoved. The decline continued, confirming something the IMF discussed at length in its annual report published in October 2019: low rates make financial risks difficult to ignore, increasing the vulnerability of the financial system. In the low-rate environment, investors select riskier and less liquid investment targets in order increase yield, amplifying the impact when the market turns.

Another characteristic of this China-dominated economic order has been muted inflation around the world. Previously a constant concern in monetary policy, this production concentration greatly reduced the cost of monetary easing.

Evaluations of China’s ability to resolve the past crisis are polarized. Taking a broad view, only in China’s system could hundreds of millions or even a billion laborers be mobilized to achieve centralized manufacturing on such a scale. Some have praised China’s boldness and resourcefulness, while others argue that its forceful response only extended and postponed the problem. In particular, the debt overhang from the stimulus plan continues, and will be a major concern for future growth. This pandemic marks a turning point for the era of “Made in China,” testing the resilience of the global economy.

B: Further Stabilization Efforts after First Outbreak

After Wuhan announced is closure on January 23, other parts of China followed in turn. Factories shut down, and consumer activity was also frozen. According to a report by the National Finance and Development Center of the Chinese Academy of Sciences, the impact of COVID-19 on China’s finances will be larger than that of SARS. The epidemic area accounts for 90% of China’s population, while with SARS it only accounted for 18%; and for GDP, it accounted for 92%, versus 26% for SARS.

In early February, the Tsinghua University School of Economics and Management and Peking University HSBC Business School surveyed 995 SMEs, finding that if the epidemic situation continued, 85% of them would have insufficient cash flow to last three months, and most would have to close their doors. Another report by the Chinese Academy of Social Sciences found that about 96% of companies would not withstand more than two months of shutdown.

The government has also gone to great lengths to maintain economic confidence. Despite the city closures, work stoppages, frozen consumption, and corporate cash flows, financial markets have remained unmoved, as a result of the government’s “flood-like” stimulus. However, the funds supporting these policies may come from banks or insurers, and their losses may end up threatening future operations and concealing greater risks.

In order to save business from a wave of collapses, the central bank, Ministry of Finance, China Regulatory Banking Commission, China Securities Regulatory Commission, and Foreign Exchange Bureau jointly issued the Notice on Further Strengthening Financial Support for the Novel Coronavirus, which included “business loans that cannot be paid on time can be extended or renewed,” “lower the loan interest rate, and increase medium- and long-term lending,” and “reduce guarantee and re-guarantee fees.” In February alone, epidemic-related refinancing increased from RMB 300 billion to RMB 500 billion. In addition, the Notice also required rapid ‘green channel’ approval for the main epidemic-related bonds. According to statistics from Wind, 249 corporate or local bonds were related to epidemic assistance in February alone, totaling RMB 187.2.

Although resources have been poured into industry, though, their distribution has been uneven: state-owned enterprises have been far more likely than private-sector businesses to receive them. Owing to past policy support and relative ease of obtaining financing, however, their performance has been lackluster. In the end, they may not only be able to survive the downturn, but also to acquire worse-performing private companies. Such cases have already appeared. The epidemic will accelerate “the advance of the state and retreat of the private sector,” further distorting the future economy.

C: The Ongoing Pandemic Shakes up the Current Economic Order

Precisely because of China’s previously indispensable status in global trade, the COVID-19 epidemic considerably shook up international labor patterns, which will also affect China’s future role in the international economy. The pandemic has already caused products related to iPhone assembly and raw materials, for instance, to run out of stock.

Making matters worse, just as China went all-out to support business and tried to resume production, the epidemic broke out in Japan, Korea, the source of many important raw materials and parts. Thus, work stoppages that were originally only within China turned into cross-border supply chain issues. What was previously an efficient division of labor became a new risk.

The pandemic eventually spread from the supply side to consumer demand. In a short time, the virus spread out of control to the US and Europe. Following the positive diagnoses of celebrities and dignitaries, demand in developed markets – already weak – froze. In other words, just as Asia was eager to repair its demand chains, the West stopped importing. On top of that, OPEC countries including Saudi Arabia broke off negotiations with Russia on production, causing crude oil prices to plummet. Investors were concerned that the price would fall beneath the production costs of American shale producers, causing bankruptcy, and the bottom fell out of the US stock market.

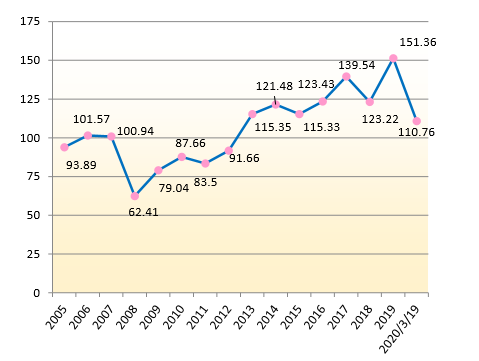

In the financial markets, although US stocks have been breaking records, investors know that that the cause is longstanding monetary easing, which is not reflected in the real economy. Before this crash, the US stock market was worth over 150% of US GDP, a historical high. Despite this performance, various “black swan” stories were never refuted. This made investors extremely sensitive to any bad news that might arise, not to mention this once-in-a-century virus. President Trump’s mention of bailouts several times only caused further volatility, and the dust still hasn’t settled.

Source: MacroMicro

Source: MacroMicro