2020 Critical Financial Trends: Covidnomics Outlook - Part I2020/04/24

Part II: The Aftermath

D. A Rising Tide Lifts All Boats. How About a Falling Tide?

Just as a human might need some time to adjust after an infection, the global COVID-19 pandemic and a mismatch between energy supply and demand have ended the decade-long US bull market, creating global shock waves. But longstanding globalization trends will also be greatly affected. The most important question going forward will be whether the financial physique can withstand this trial without triggering any further complications.

Ever since the financial crisis in 2008, QE, along with China’s endless fiscal expansion, have been major factors supporting the financial market. These also however caused the markets to decouple from the real economy. The balance sheets of the Fed and financial institutions greatly expanded, giving the market funds without end. Long-term low interest rates explained the market enthusiasm, but financial assistance to improve the real economy remained limited.

In this globalized structure, manufacturing remained concentrated in one country – China. Marketing and channel operations were the responsibility of US brands, and finances were the responsibility of a China-friendly Wall Street, turning the international division of labor since 2008 into a China-centric system. The large number of China-focused stocks listed on Wall Street embodied the relationship between China and the US in this new order.

This pandemic followed in the heels of the trade war between the US and China last year, which will bring changes in the current system, directly impacting China’s attempt to dominate next-generation manufacturing.

After all, the reason production came to be concentrated in China was the use of international trade to maximize shareholder returns. US solar panel, chip, and cell phone innovators were unable to maintain domestic production, and could only hand over market share to state-supported Chinese competitors. President Trump’s measures to reverse this process, coupled with the economic damage from COVID-19, will force these Chinese value chains to relocate. The new economic order will inevitably determine subsequent global growth prospects and patterns.

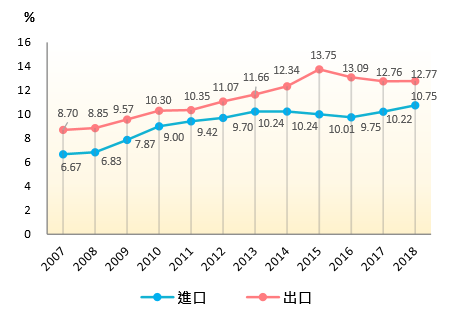

China’s Portion of International Imports and Exports

>Source: WTO, China National Bureau of Statistics

>Source: WTO, China National Bureau of Statistics

E: After COVID: Economic Reorganization and New Momentum

Unquestionably, the pandemic has severely impacted the aviation, F&B, and hospitality industries. Even without systemic financial feedback effects, the pause in economic activities will still inevitably have a strong impact on the global economy.

At the same time, some industries have shown growth potential, including pharmaceuticals, nursing equipment, online shopping, video equipment, and online learning. Not only have these industries benefitted from the epidemic, but their long-term trends are aligned with social needs. The COVID-19 pandemic will be a rare opportunity for these technology-focused industries to turn themselves into a whole ecosystem.

When Wuhan was closed for two months, for example, residents continued to use financial services at home without the need for ATMs. No currency crisis emerged, pointing towards the inevitable integration of real and virtual bank channels. After this pandemic is over, we will further question the necessity of high in-person transaction volume, and the working rights of tellers. Physical branches will become much less useful. Similarly, outside of China, many top US schools have switched to online learning. Massive Open Online Courses (MOOCs), which have been around for some time, have reached a key juncture, and now have the opportunity to replace the blackboard-based classroom methods of the past 200 years. The epidemic will mark an industry paradigm shift.

With China as the epicenter of the outbreak, the past thinking of using Chinese manufacturing as a core growth engine will be challenged, and backup and diversified production bases will become necessary risk measures. In particular, the ongoing trade war, and the skepticism of Made in China 2025, will delay the plans for China’s manufacturing upgrade. If China reorganizes itself towards the public sector, it will have to rely more on internal consumer markets, which have taken a battering following the epidemic. Due to its debt situation, it will be more difficult for China to save the world economy with major infrastructure investment to, as it did in 2008. Its economic peak may turn out to be a new growth opportunity for the rest of the world.

Taiwan’s quality control and governance have meanwhile boosted its brand image. This episode, combined with the results of the New Southbound policy over the past few years, and the two-way links it has gradually built with the US and Europe, starting from zero, may give it a new standing in the international economy.

In this international economic reorganization, electronics and technology chains must seize the opportunity to move to the industry core. Other important directions for Taiwan include added value in other manufacturing industries and the expansion of financial and medical service brands.

F. Policy Recommendations: Taiwan’s Industry Transformation

Confidence among everyone affected by the global recession must be rebuilt when the storm subsides. It is worth considering how Taiwan should continue to build on the foundation of its previous epidemic response in terms of economic policy, carrying out disaster relief while also planning industry recovery.

In addition to financial disaster assistance, considering the international situation, the short-term relief plan should also emphasize support for domestic services. In tourism and F&B, for example, investment subsidies for environmental sanitation and digital E-commerce devices can be considered when consumption is tight. Once the pandemic subsides, this can be supplemented with content on the achievements of Taiwan’s disaster management, expanding international brand awareness and improving overall value added. In domestic services, the pandemic has increased recognition of health insurance and medicine. The financial health of the insurance system can be improved, while expanding the market basis of health promotion and long-term care, and further digitalizing health services so that medical bills don’t become a major burden.

Industry reconstruction is even more important than these short-term measures. It has become difficult to rely solely upon monetary policy. Loose monetary policies have been implemented around the world for a long time, but few attempts have been made to shrink balance sheets, so the space for further expansion is limited. Expansionary fiscal policy and structural reform should play a role. In the current international situation of low interest rates and controlled inflation, it would be good to make good use of the existing domestic savings surplus.

More specifically, Class B construction bonds, which have not been issued for a long time, are an optimal channel. This old commodity with a minimum interest guarantee and an infrastructure lock-in function will allow domestic funds to be used to improve Taiwan’s competitiveness, assisting in financial industry recovery as global rates and interest spreads remain low. Infrastructure with large service volumes and room to increase service fees under democratic supervision, such as third terminal buildings, seismic improvement, leakage prevention in reservoirs, and reconstruction of medical facilities are all good targets for such debt issuance. Using debt issuance to attract overseas funds back to Taiwan would prevent depreciation or other problems from overseas investments, which would be an important way for Taiwan to improve its infrastructure as global manufacturing chains are restructured.

In particular, continuing on last year’s trend of capital repatriation, in which high-quality manufacturing returned home, supporting the economy, to prevent future supply chain risks, the government can more actively assist manufacturers returning home. Regarding situations where Chinese upstream and downstream bases have not resumed production, lack workers, or have insufficient raw material supplies, for the long term, besides the existing support, key production capacity and industry chains should be studied as soon as possible to plan repatriation subsidies or assist in transfer to other overseas production bases. Doing so will reduce the risk of having too many eggs in one basket.

In other words, the government and society previously considered overseas market development policy from the perspective of trade. After this pandemic, however, they must consider manufacturing from a forward-looking perspective. Instead of looking at national borders, they should consider Taiwanese production chains first to determine international layout.

Of course, these are not one-time efforts and changes, and require more research and policy support. This disaster situation will require both ‘learning from doing’ and ‘doing from learning.’ For example, in order to build up supply chains in key industries like semiconductors, immediate action is necessary to give clear destinations to returning capital.

In addition, the government should pioneer new service models and create new business opportunities. The current mask provision and public health processes have effectively integrated open information resources, creating a new government service experience. There is still great room for improvement in healthcare, education, finance, and other public services. This open data experiment of life-and-death importance is also an opportunity to clarify separation of data ownership and privacy issues in Taiwanese civil society. For example, v2.0 of the mask app includes e-payments from a variety of financial institutions, a great demonstration of joint innovation. Future use of central bank digital currency and digital ID application should also be explored now. After planning is complete, Taiwan’s new public services will become a unique advantage for its industry.

Lao Tzu wrote, “Misfortune depends upon fortune; fortune conceals misfortune.” Because Taiwan interacted with China so frequently, it was first to enjoy the benefits of its development, and was also the first to become aware of possible risks.

Forward-looking industry-finance joint development, allowing Taiwan to grab new development opportunities during this global reorganization, will be the first major challenge of the newly re-elected government. After this pandemic, people around the world who have watched Taiwan’s successful response will wait to see if its economic miracle can be revived.