Currency Gallery

Before the advent of currency, people exchanged necessities by barter. Afterwards, objects with fair value, such as shells, furs, precious metals, etc., began to be used as convenient media of exchange. Since these items were both commodities and currencies, they became collectively known as commodity money.

Source: National Museum of History

During the Spring and Autumn Period and Warring States Period, metal casting techniques were advanced, and currency started to be cast in mass production. Coins were named after their shape as a spade or weeding tool. Spade money, for example, was a bronze coin based on the "Bu" (a bronze agricultural tool).

Source: National Museum of History

Early metal coins did not have a uniform appearance, so both the vendor and purchaser had to check the purity and weight every time. The Lydians, a kingdom in Asia Minor, issued the earliest standardized currency system in the 6th century BC, stamping a fixed weight and shape for recognition. The electrum coin was composed of alloy of gold and silver in 3:1 proportion, known as electrum.

Source: The British Museum

The First Emperor of the Chin Dynasty introduced a uniform currency called “banliang,” a round copper coin with a square hole in the center. These coins were used as legal tender and served as a prototype currency of future dynasties.

Source: The British Museum

The use of Silver Sycee as a store of value dates back to the Han dynasty, and it became a transaction currency in the Song dynasty. During the Yuan dynasty, it was shaped as a boat or shoe, known as “Yuanbao,” which became a common form for the next few centuries. The hoof-shaped silver sycee was also known as "Horse Hoof Silver". After the Ming dynasty, it became the main currency until the late Qing dynasty, when it was replaced by new machine-minted coins.

Source: National Museum of History

Modern silver-milled coinage dates to the 15th century in Europe. It has been granted legal significance by many countries, and is the contemporary silver standard currency in circulation. The "Pillars of Hercules" silver Spanish coin, which was circulated in Europe and China from 1535 to 1821, is one of the most representative coins for international trade.

Source: The British Museum

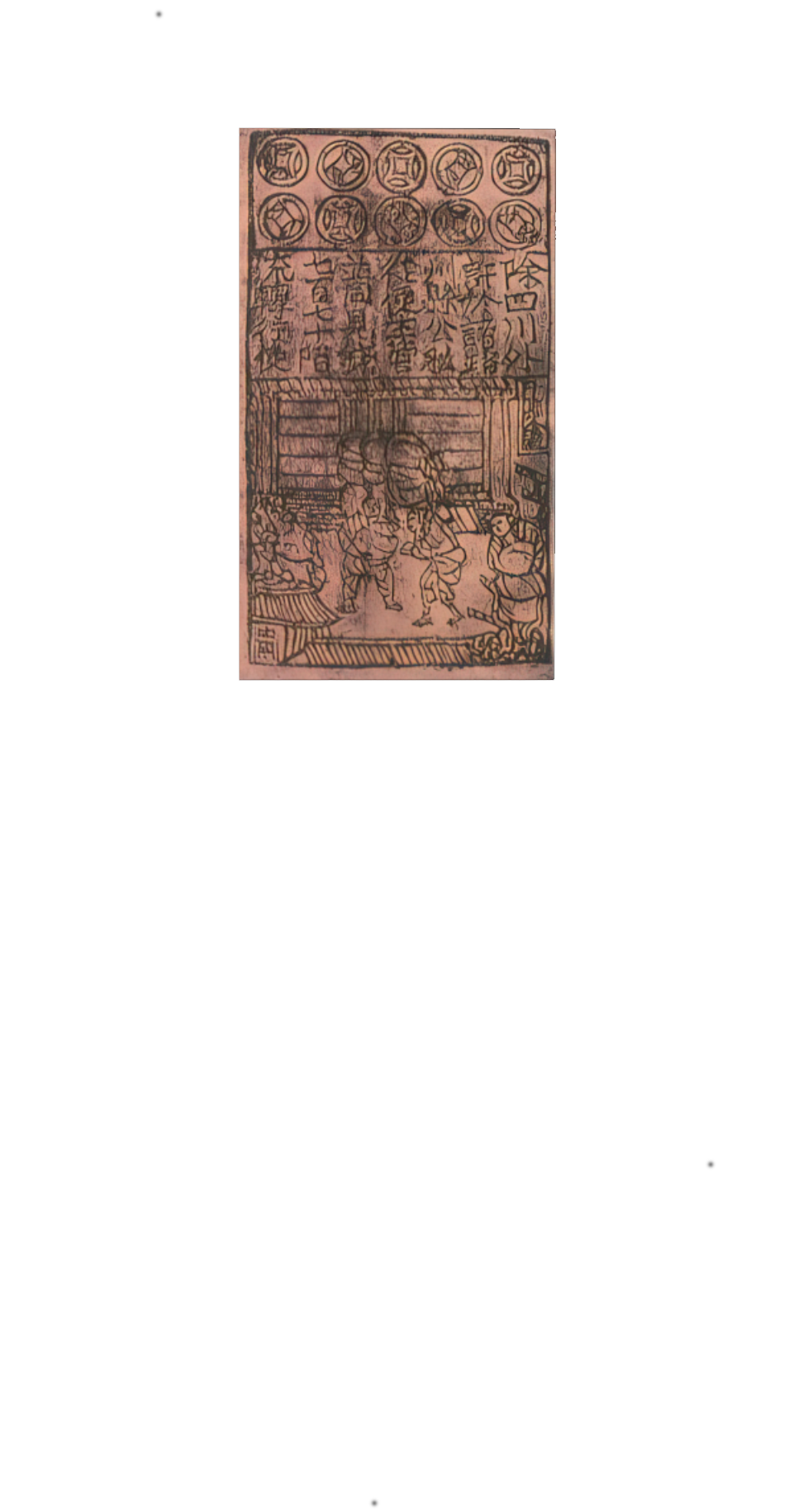

Due to the inconvenience of carrying metal coins, as well as the maturity of printing technology, paper money was invented. Jiaozi, issued during the Song dynasty in China, was the first paper money in the world. It was originally used as a proof of notes, and people kept their money in jiaozi bu (paper note banks) in exchange for the jiaozi; subsequently, it was issued by the government and became official legal tender.

Source: The British Museum

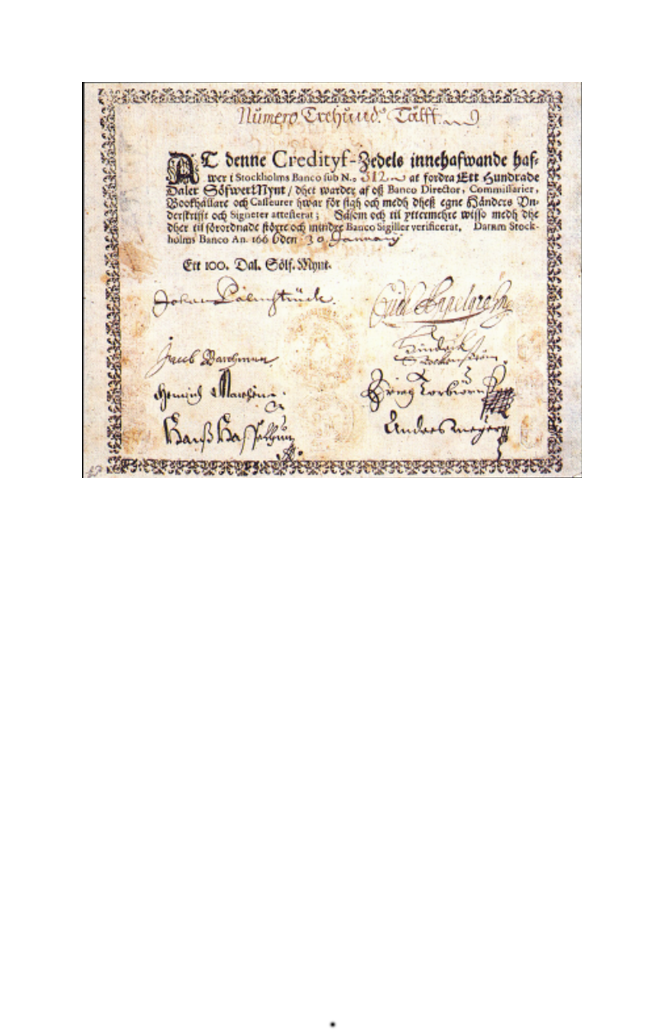

The Bank Note is a promissory note issued by a bank, payable to the bearer upon demand. In 1661, Stockholms Banco issued the first bank note with a value greater than its physical reserves in the form of debt, whose value depends on public trust in the bank. The notes are credited as the first modern banknotes.

Source: The British Museum

The US dollar is issued as legal tender by the Federal Reserve. The value of a fiat currency depends on the trust placed in the issuing country, rather than on any commodity or physical object. Because of its significant role in global trade, the US dollar is a common medium of transaction for international trade and is the main international reserve currency.

Source: The British Museum

The euro is issued by the European Central Bank (ECB), a joint organization of the EU members, and has been in circulation since 2002. Within the eurozone, EU members are able to trade in a unified currency for more efficient transaction.

Source: The British Museum

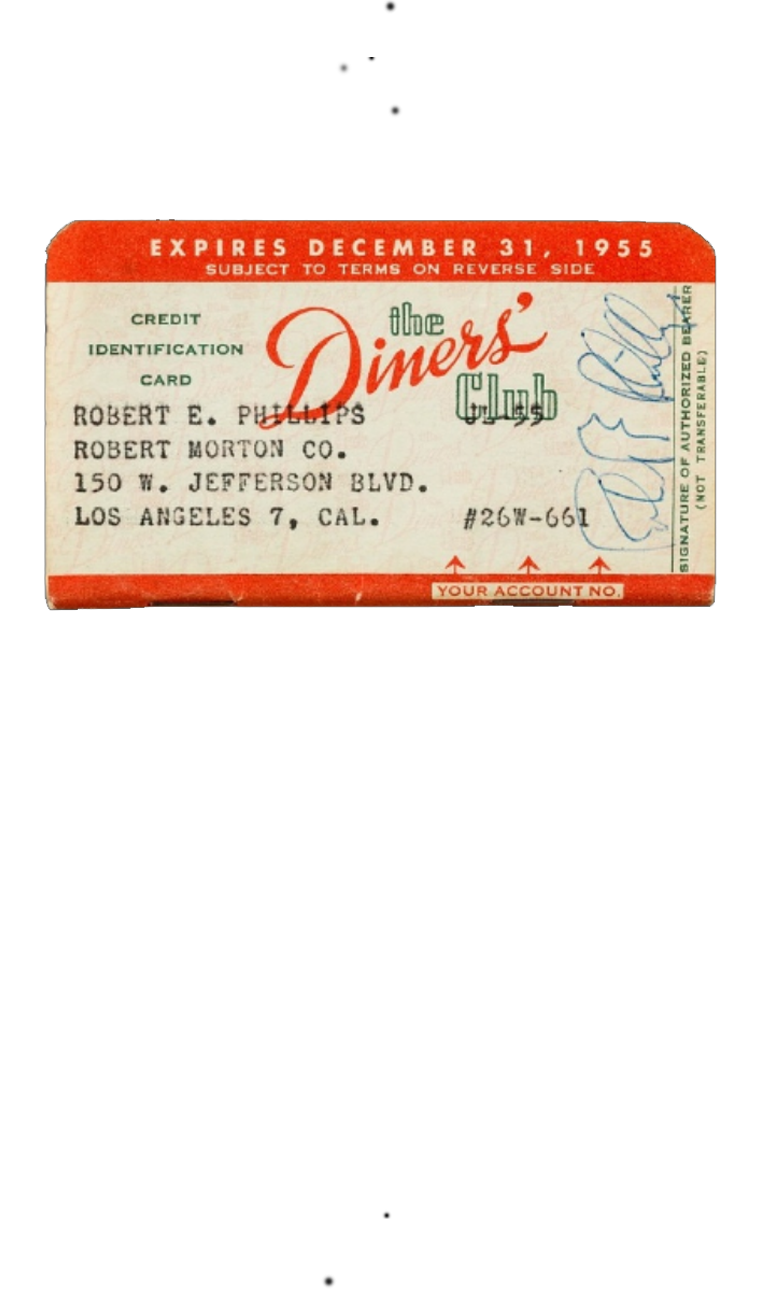

In 1950, the US Diners Club created a system that allowed its members to use cards to purchase at designated stores and pay later – the first charge card in the world. The transaction model also evolved into bank cards, credit cards, and other payment instruments that emerged in the 1960s.

Source: The Smithsonian Institution

In the 1980s, with advances in information and communications, electronic money was used to store prepaid value in electronic form on the secure chip of a card, or in smartphone apps or on websites. The stored value is then transferred through a card reader or over the internet. EasyCard is one example.

Source: The EasyCard Corporation

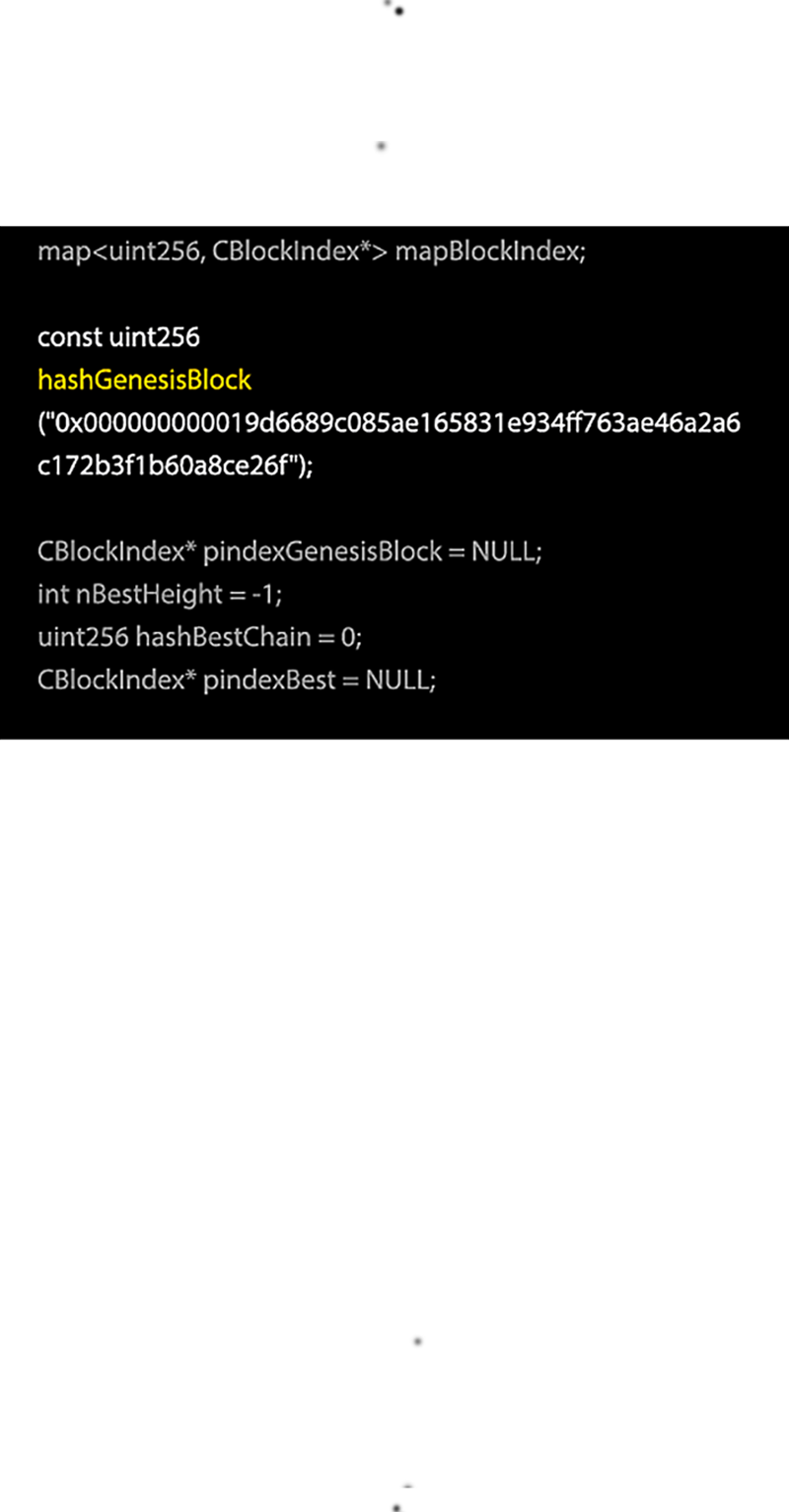

Cryptocurrency is a virtual currency built using a block cipher, without relying on any third-party authentication. Each currency is stored in a blockchain system to secure transaction records. The first cryptocurrency was Bitcoin.

Central Bank Digital Currencies (CBDCs) are digital currencies issued by a central bank. CBDCs improve financial inclusion, maintain the role of the state in the payments market, and adapt to the trend of digital payment. In 2020, the Bahamas issued the first CBDC, Sand Dollar, to improve the efficiency of its payment system and make it easier for remote people to get cash.

Source: Central Bank of the Bahamas