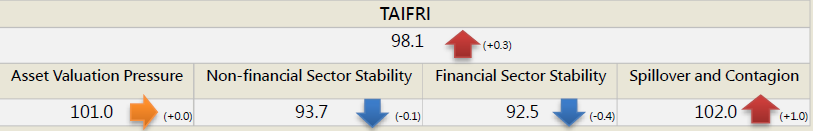

【November TAIFRI Highlights】

-

November TAIFRI index scored 98.1, up 0.3 from October

-

Real estate market risk has stabilized; stock market volatility has risen

Residential rents in Taipei grew significantly in November, reducing real estate market risk. The stock market P/E ratio has increased slightly for two months, and risk premiums have decreased accordingly, but overall stock risk is still easing compared with H1. The Taiwan VIX rose due to increased uncertainty after a the Omicron variant appeared in late November.

-

The new variant raised concerns in domestic and overseas markets

In overseas markets, VIX and CDS indices rose significantly in November, reflecting concerns about economic prospects. The risk of domestic financial market contagion also increased, but is still the second lowest this year, showing stable systemic risk.

-

Abundant liquidity in the corporate sector; demand for high-yield bond funds remains strong

In the corporate sector, although the rate on BBB corporate bonds has grown for two months, and the yield on public bonds remains high, the spread between the two has reached the third lowest since the sample period (2007/8 so far), showing a low cost of capital. The growth rate of bank lending to corporates is also the second highest this year, and liquidity is abundant. In the household sector, total investment in overseas high-yield funds has remained 11x that in general bond funds for three months. In banking, the NPL coverage and capital adequacy ratios are both in the best range in history; the financial system is healthy.

--For the complete content, please download the file below