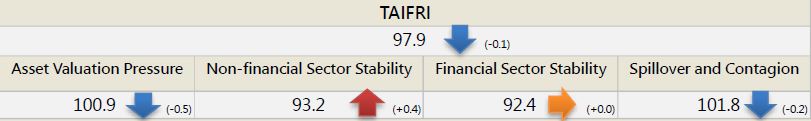

【December TAIFRI Highlights】

-

December 2021 TAIFRI score was 97.9, down 0.1 from November

-

Real estate market risk increased slightly; stock market risk eased from H1

At the end of the traditional peak homebuying season, prices and volumes both increased, increasing market risk. The stock market P/E ratio has risen slightly for three months, risk premiums have narrowed. Although the pandemic is flaring overseas, the volatility of Taiwan stocks slowed, and TAIWAN VIX fell sharply, indicating that domestic market confidence has stabilized.

-

The influence of the new variant has grown overseas; the risk of domestic contagion has eased

In overseas markets, with the rapid increase in Omicron cases, European VIX and CDS index both broke new highs in 2021; the US CDS index also hit its second highest in 2021. With a more stable situation, in contrast, Taiwan’s financial contagion risk index fell from November and hit the second lowest level in 2021, indicating that systemic risks are stabilizing.

-

Rate spread hit a new low and with expectations of rate hike; growth in corporate financing soared

In the corporate sector, rates on BBB-rated corporate bonds hit a new high for 2021, and government bond yield also rose sharply to a new high since March 2019, the spread between the two has reached the lowest since the sample period (2007/8 so far). With low cost of capital and expectation of rate hikes, corporates rushed to borrow before year end, causing corporate lending to grow at a new high since September 2011. Banks’ NPL, bad debt coverage and capital adequacy ratios are all at historical bests.

--For the complete content, please download the file below