July Highlights

-

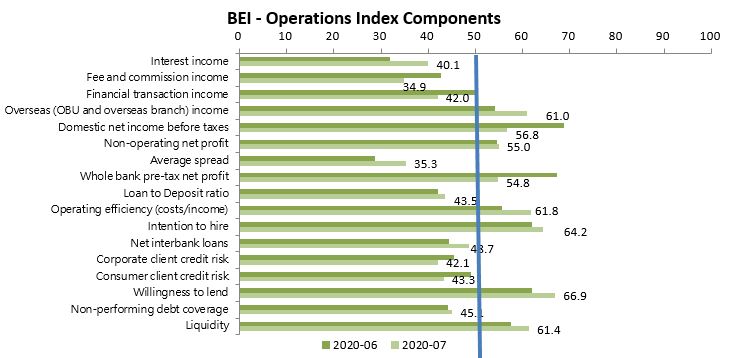

The Operations Index remained above 50 this month, but the trend is weaker than expected

The BEI Operations Index remained above 50 this month, but the trend was unexpectedly weak. Bankers expect overseas business to recover in the next 3 months. The domestic focus remains on credit quantity and price performance. The FSC’s and Central Bank’s SME rescue package is expected to continue. The Central Bank will maintain the policy rate for the year, the deposit rate will remain around 1.2% for 3Q, and overall interest income is expected to gradually recover with stable prices and increasing volumes. Asset trusts and funds will become the main source of fees and commission income in the case that insurance policy fee income is greatly reduced.

-

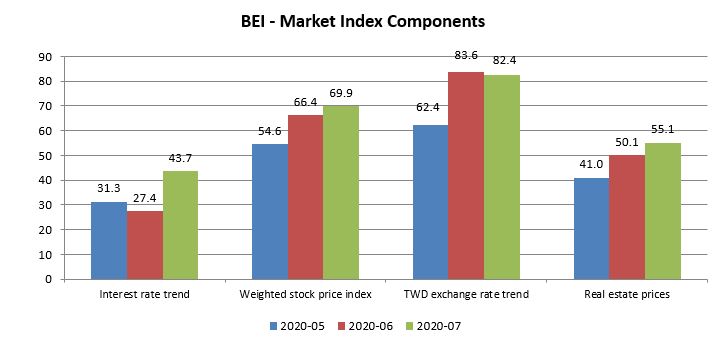

Strong domestic stock market performance, BEI Market Index is optimistic

For the Market Index, the Central Bank has not cut interest rates again since March. Bankers also believe that domestic rate cuts have slowed, and their views stabilized. Sub-index scores rose sharply since last month. For the stock market, Taiwan has effectively controlled the pandemic, and its politics and economics are stable, attracting capital inflow. ICT, which accounts for over 40% of Taiwan’s exports, performed well in 1H, and with continued capital repatriation effects, bankers maintained medium- and long-term confidence in equities, driving a strong upward trend in exchange rate scores. The stock market also drove the housing market sub-index further above 50.

-

International and domestic financial and business focus points for the next three months

1. The continuing COVID-19 pandemic; 2. Crude oil price volatility; 3. The financial impact of monetary easing; 4. Bailout policies around the world; 5. The impact of the FSC’s measures to strengthen insurance policy management on banks’ wealth management; 6. Developments in the US-China trade and technology war; 7. The impact of Hong Kong’s security law on global economics and trade; and 8. The three domestic online-only banks and their impact on traditional banks.

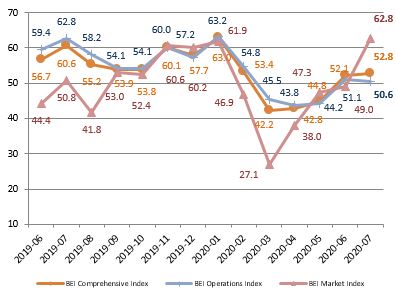

BEI Trends

The July 2020 BEI Comprehensive Index scored 52.8, 1.34% higher than the 52.1 in June. The Operations Index scored 50.6, down 0.98% from the previous 51.1. The Market Index scored 62.8, up 10.37% from the previous 56.9, bringing the entire Comprehensive Index up over 50.

The Operations Index remained above 50 but the trend was weaker than expected. Bankers expect overseas business to recover in the next 3 months. The domestic focus remains on credit quantity and price performance. The FSC’s and Central Bank’s SME rescue package is expected to continue. The Central Bank will maintain the policy rate for the year. the deposit rate will remain around 1.2% for 3Q, and overall interest income is expected to gradually recover with stable prices and increasing volumes. Asset trusts and funds will become the main source of fees and commission income in the case that insurance policy fee income is greatly reduced.

The Market Index scored 62.8, up 10.37% from the 56.9 in June. The Central Bank has not cut interest rates again since March; bankers also believe that domestic rate cuts have slowed, and their views stabilized. Sub-index scores rose sharply since last month. For the stock market, Taiwan has effectively controlled the pandemic, and its politics and economics are stable, attracting capital inflow. ICT, which accounts for over 40% of Taiwan’s exports, performed well in 1H, and with continued capital repatriation effects, bankers maintained medium- and long-term confidence in equities, driving a strong upward trend in exchange rate scores. The stock market also drove the housing market sub-index further above 50.

BEI - Market Index Components

BEI - Operations Index Components

Changes since last month

| Rank |

Best performing indicators |

Worst performing indicators |

| 1 |

Interest income |

Whole bank pre-tax net profit |

| 2 |

Average spread |

Fee and commission income |

| 3 |

Overseas (OBU and overseas branch) income |

Domestic net income before taxes |

| 4 |

Operating efficiency (costs/income) |

Financial transaction income |

| 5 |

Net interbank loans |

Consumer client credit risk |