【December TAIFRI Highlights】

-

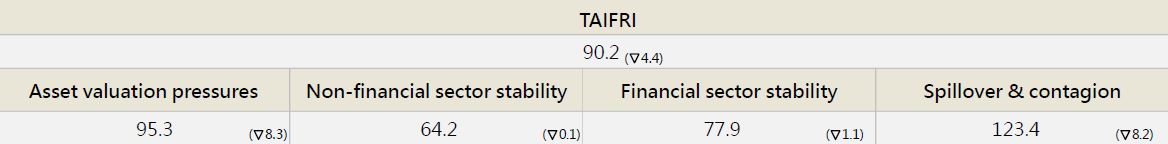

TAIFRI scored 90.2 in December, down 4.4 from November

-

Stock market price volatility declined sharply

Taiwan P/E raito fell, and volatility slowed significantly. The Taiwan VIX has fallen for three months in a row, reaching a new low for 2022.

-

Overseas market risks cooling down

The VIX and CDS indexes of the US, China, Japan, and Europe all fell; overseas market risk fell to a nearly 10-month low. Domestic financial market contagion risk has declined for six months, reaching a new low since November 2021, indicating a lower risk of contagion among financial institutions.

-

Corporate financing costs rose slightly, while corporate lending continued to grow steadily

Overall NPL and bad debt coverage ratios were stable, and capital adequacy was also at a healthy 14%, indicating a sound capital structure. Bank lending to corporates has shown double-digit growth since July, with strong momentum. BBB corporate bond rates continue to rise, however, and the gap with 10-year government bonds has widened to 0.9 percentage points, a record high since 2021.

--For the complete content, please download the file below