June Highlights

-

Main indicators perform well, and BEI Operating Index rebounds above 50

The pandemic has subsided domestically and domestic stocks have stabilized. In order to boost private consumption, the government has issued 3X face value stimulus coupons. Bankers’ views on the creditworthiness of their consumer and corporate customers for the next three months approached neutral, indicating lower concerns over credit risk. Interest rates remain low; due to effective pandemic control, the Central Bank currently has no plan to lower rates. Bankers’ views on interest income for the next three months improved slightly but remained conservative. Lower required reserves may reduce processing fees and deposit income, but views on profitability turned positive overall.

-

Views on stocks and housing further rebounded; Market Index rebounds above 50

For the BEI Market Index, investor confidence has recovered, and the Central Bank decided in its 2Q meeting to leave rates unchanged. Bankers’ views on interest rates declined slightly; the US Fed promised that rates will remain low until the economy recovers. There are signs of a resurgence after the US, Europe, and China opened back up. USD depreciation and international hot money have pushed the NTD up; the continued low-profit environment and monetary easing will help the real estate market in 2H. Bankers’ views on real estate rebounded over 50. Second coronavirus waves in Europe, the US, and China have not been contained, and the continued US-China trade war has benefitted Taiwanese manufacturers. 5G rollouts will drive related stocks. Bankers are positive about trends in the market for the next three months.

-

Bankers’ focus points in the international financial and economic environment

1. The global economic impact of the COVID-19 crisis; 2. The effects of crude oil volatility; 3. The effects of loose monetary policies on financial markets; 4. The impact of bailout policies on global economies; 5. The effects of the FSC’s stronger insurance policy management on domestic banks’ wealth management business; 6. Continuing trade and technology war developments; 7. The effects of Hong Kong’s security law; and 8. The opening of three new online-only domestic banks.

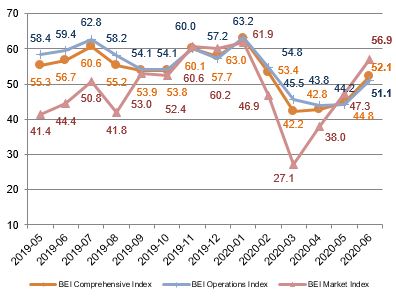

BEI Trends

The BEI Comprehensive Index scored 52.1 in June 2020, 16.29% higher than the 44.8 in May. The Operations index compiled 51.1, 15.61% higher than the 44.2 in May. The domestic pandemic situation has subsided, the market has stabilized, and the government has issued 3X face value stimulus coupons to stimulate consumption. Bankers’s views on the creditworthiness of their consumer and corporate customers for the next three months turned flat, indicating lower concerns over credit risk. Interest rates remain low; due to good control over the pandemic, the Central Bank currently has no plan to lower rates. Bankers’ views on interest income for the next three months improved slightly but remained conservative. Lower policy required reserves may reduce processing fees and deposit income, but views on profitability turned positive overall.

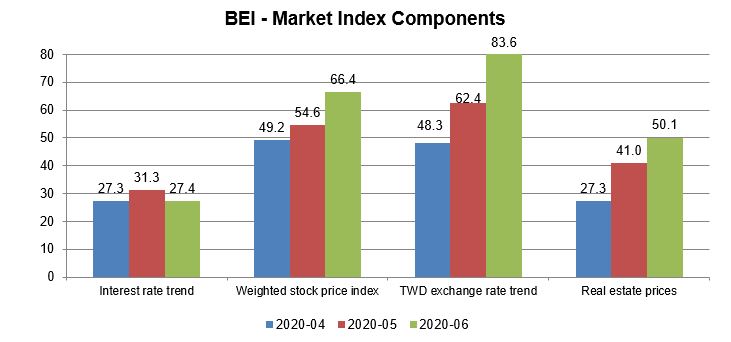

The BEI Market Index scored 56.9, 20.30% than the 47.3 in May. Investor confidence has recovered, and the Central Bank decided in its 2Q meeting to leave rates unchanged. Bankers’ views interest rates for the next three months declined slightly to 27.4. The US Fed promised that rates will remain low until the economy recovers. There are signs of a resurgence after the US, Europe, and China opened back up. USD depreciation and international hot money have pushed the NTD up, and the NTD Exchange Rate Index increased slightly to 83.6. The continued low-profit environment and monetary easing will help the real estate market in 2H, and views on the real estate market rebounded over 50 to 50.1. Second waves in Europe, the US, and China have not been contained, and the continued US-China trade war has benefitted Taiwanese manufacturers. 5G rollouts will drive related stocks, stabilizing the market. The FSC lifted its conditional short bank, and bankers are positive about trends in the market for the next three months, at 66.4.

BEI - Market Index Components

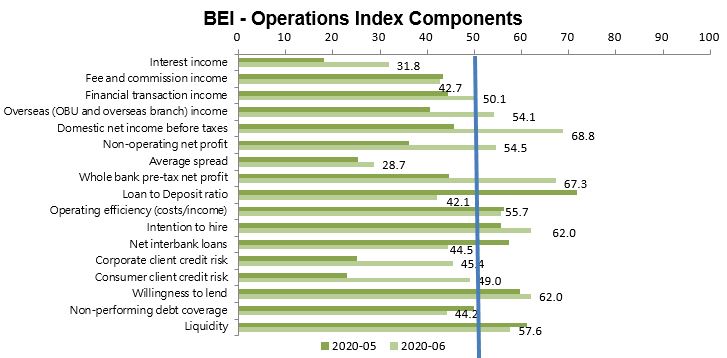

BEI - Operations Index Components

Changes since last month

| Rank |

Best performing indicators |

Worst performing indicators |

| 1 |

Consumer client credit risk |

Loan to deposit ratio |

| 2 |

Corporate client credit risk |

Net interbank loans |

| 3 |

Interest income |

Non-performing debt coverage |

| 4 |

Whole bank pre-tax net profit |

Liquidity |

| 5 |

Non-operating net profit |

Fee and commission income |