April Highlights

-

BEI Operations Index continued to decline due to coronavirus

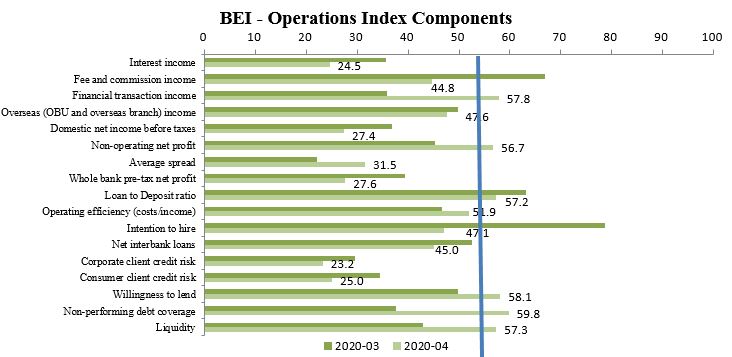

The BEI Operations Index was affected by the impact of the coronavirus on the global economy. The unemployment rate rose as a result of pandemic response measures. Governments launched various support and bailout policies. In March, the central bank announced a rate reduction, and the Executive Yuan required all banks to lower their rates. On April 1, in order to increase banks’ willingness to lend, it launched a NT$ 200 billion SME financing package. On April 27, the Central Bank lowered its lending rate to banks from 0.25% to 0.1%, greatly reducing financing costs and increasing banks’ spread. Executives’ expectations of hiring, fees and commissions, interest income, pre-tax income, and customer credit risk for the next three months were all affected, and the Operations Index remained under 50.

-

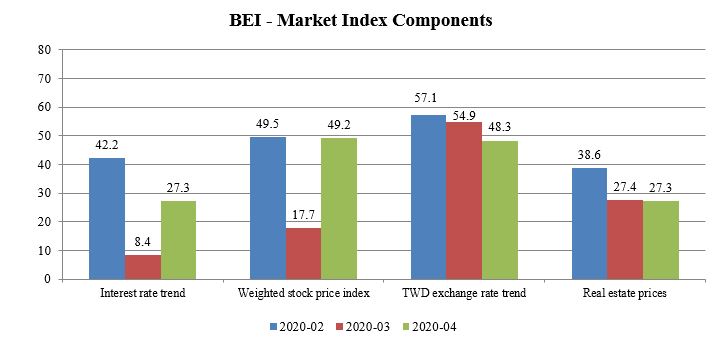

The March Market Index marked a 3.5 year low; April rebounds but remains under 50

Due to the coronavirus, the March BEI Market Index marked a 3.5 year low. As Taiwan stocks stabilized in April, executives’ views on the market improved slightly, causing the market index to increase significantly from March, although it was still weak. With the collapse of crude futures prices into the negative range, risk aversion remains high. With stimulus occurring around the world, bankers maintained low expectations of interest rate and mortgage market trends; although the pandemic has been controlled in Taiwan, the emergency has not yet been lifted. The government has launched a number of bailouts, and the National Finance Stability Fund will remain active until the end of the pandemic. Bankers’ views on the stock market remained flat; regarding exchange rates, the US dollar index remained volatile, Asian currencies depreciated sharply, and the new Taiwan dollar remained more stable than other Asian currencies. Sentiment on the new Taiwan dollar turned negative.

-

Important points to watch for the next three months

1. The impact of the coronavirus on the global economy; 2. The impact of crude oil price swings; 3. The impact of global monetary policy loosening on financial markets; 4. The impact of bailout policies around the world on the economy; and 5. The impact on domestic wealth management of the FSC strengthening insurance policy management.

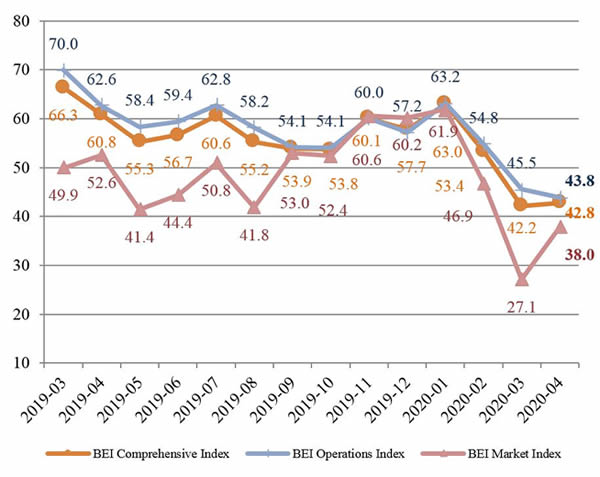

BEI Trends

The April 2020 BEI Comprehensive Index reached 42.8 points, 1.42% higher than the 42.2 in March; the Operations Index reached 43.8, 3.74% under the 45.5 in March. The coronavirus has impacted business around the world, increasing unemployment. In order to mitigate the economic impact, governments have issued various stimulus and bailout measures. After the Central Bank’s March rate cut, the Executive Yuan encouraged bank lending, and on April 1 it launched a NT$ 200 billion SME financing package to increase banks’ willingness to lend. On April 27, the Central Bank lowered its lending rate to banks from 0.25% to 0.1%, greatly reducing financing costs and increasing banks’ spread. Executives’ expectations of hiring, fees and commissions, interest income, pre-tax income, and customer credit risk for the next three months were all affected, and the Operations Index remained under 50.

The Market Index reached 38.0 points, 40.22% higher than the 27.1 in March. Due to the coronavirus, the March score marked a 3.5 year low. As Taiwan stocks stabilized in April, executives’ views on the market improved slightly, causing the market index to increase significantly from March, although still weak. With the collapse of crude futures prices into the negative range, risk aversion remains high. With stimulus occurring around the world, bankers maintained low expectations of interest rate and mortgage market trends. The interest rate index rose to 27.3, while the mortgage market index fell slightly to 27.3; although the pandemic has been controlled in Taiwan, border controls remain in place and the economy faces significant headwinds. The National Finance Stability Fund will remain active until the end of the pandemic. Bankers’ views on the stock market remained flat; the share price index jumped sharply to 49.2; as for exchange rates, the US dollar index remained volatile, Asian currencies depreciated sharply, and the new Taiwan dollar remained more stable than other Asian currencies. Sentiment on the new Taiwan dollar reached 48.3.

BEI - Market Index Components

BEI - Operations Index Components

Changes since last month

| Rank |

Best performing indicators |

Worst performing indicators |

| 1 |

Financial transaction income |

Intention to hire |

| 2 |

Non-performing debt coverage |

Fee and commission income |

| 3 |

Average spread |

Interest income |

| 4 |

Liquidity |

Whole bank pre-tax net profit |

| 5 |

Non-operating net profit |

Consumer client credit risk |