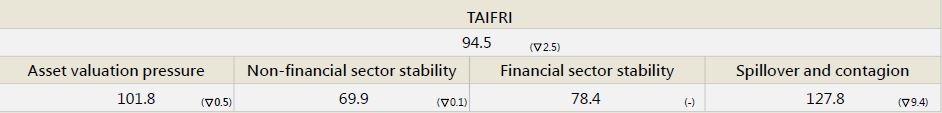

【August TAIFRI Highlights】

-

TAIFRI index scored 94.5 in August, down 2.5 from July

-

Stock market and housing risks eased

TWSE's P/E ratio has remained between 10-11 times for three months, and yields have also remained at 8%. In addition, volatility declined slightly, and stock market risk decreased. In real estate, the housing price-to-rent ratio has declined for three months, and market risks have eased amid the slowdown in price growth and stronger rental growth momentum.

-

Overseas market risk and domestic financial market contagion risk have eased

Both VIX and the credit default swaps (CDS) declined in the US, China, Japan, and Europe, Taiwan’s major exposure areas, which was the main reason for August’s TAIFRI decline, but overall overseas market risk still remains at a high for the year. Domestic contagion risk index has declined slightly for two months, indicating less risk of systemic risks among financial institutions.

-

Bank asset quality and corporate lending grew steadily

Overall NPL and bad debt coverage ratios remained the best levels in history in August, and asset quality was stable. In terms of capital structure, average capital adequacy ratios have remained at 14%-15% since the beginning of this year, and banks’ capital structure is very sound.

--For the complete content, please download the file below