【November TAIFRI Highlights】

-

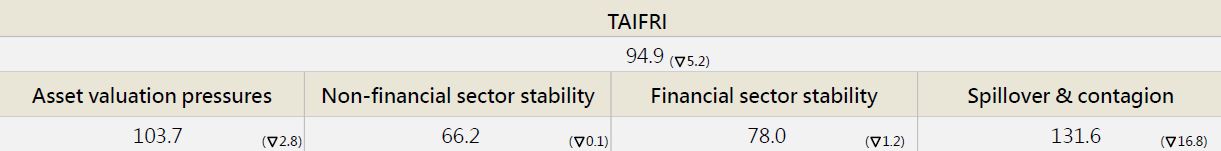

TAIFRI index scored 94.9 in November, down 5.2 from October

-

Stock market recovers; price volatility subsides

Taiwan P/E ratio rebounded to 10 in November for the first time after two months of decline; earnings yield fell by more than one percentage point, but market volatility slowed significantly. Taiwan VIX has declined for two months, and price volatility risk has dropped significantly. This was the TAIFRI sub-factor with the largest risk reduction this month. In real estate, residential rents fell slightly due to increased rental supply at the end of the year, while sales prices did not change significantly.

-

Overseas market risks subside

Besides China VIX, which has now risen for 3 months due to the pandemic, the VIX of the US, Japan, and Europe all declined; credit risks also dropped significantly. Domestic financial market contagion risk has declined for five months, hitting a low this year.

-

Bank asset quality and corporate lending grow steadily

Overall NPL and bad debt coverage ratios are stable. Capital structure is very sound; capital adequacy ratio has averaged 14%-15% for the whole year. Corporate lending has returned to double-digit growth since July, and this strength is expected to continue.

--For the complete content, please download the file below