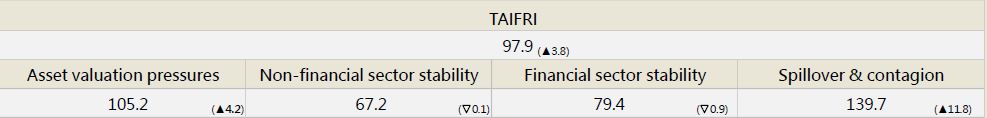

【September TAIFRI Highlights】

-

September TAIFRI score reached 97.9, up 3.8 from August

-

Increased stock market volatility

The unchanged interest rate stance of the US Federal Reserve and a major decline in US stocks affected Taiwanese stocks. TWSE P/E ratio fell below double digits in September; the initial estimate was 9.7. Stock yields rose to almost 9%. Taiwan VIX rose sharply to a new high since March 2021 – one of the main reasons for the rise in TAIFRI this month. Growth in residential rents slowed, transactions in the commercial office market cooled slightly, and real estate market risks did not change much.

-

Risks in overseas markets heat up

European credit default swaps (CDS) rose sharply to a high since the European debt crisis, and US CDS also reached a high since May 2020, indicating higher credit risks. The domestic market contagion risk index has fallen for three months, reaching a 7-month low, indicating reduced possibility of systemic risks causing chain effects among financial institutions.

-

Bank asset quality and corporate lending grew steadily

Overall NPL and bad debt coverage ratios remained stable. Capital adequacy ratios have remained at a sound level of 14%-15% since the beginning of the year. In July, the balance of corporate loans returned to double-digit growth. Since the local rate hike was not large, it was estimated that the growth trend of enterprise loans in the third quarter would still be maintained.

--For the complete content, please download the file below