【The September 2021 results draw】

-

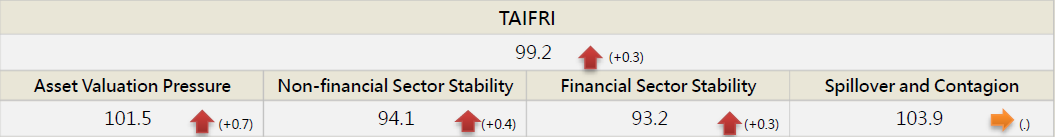

The September TAIFRI index scored 99.2 points; overall risk is slightly increased

-

Price-to-rent ratio and real estate market risk have risen

New mortgage issuance and housing price-to-rent ratios have risen for two months, increasing real estate risks in September. In the stock market, P/E ratios fell to the lowest point since 2019/3, and risk premiums rose to a new high since then, indicating lower stock market risks, but TAIWAN VIX hit a three-month high, showing higher asset valuation uncertainty.

-

Asset price volatility risk in overseas markets has risen; credit risks in the US, Japan and Europe have eased

VIX in the US, China, Japan, and Europe have all climbed significantly, especially in China, which hit a new high since 2020/6. The real estate developer Evergrande defaulted and trading was suspended, affecting China’s high-yield bond market. Regarding other international credit default indices, however, liquidity remains abundant, and credit risk has been unaffected.

-

Stable non-financial and financial sector risks

In the non-financial sector, investment in overseas high-yield debt funds has exceeded 10x that in general debt funds since 2021/3. Corporate relief loan applications have been extended until Y/E 2021, but lending is expected to subside with the lower pandemic alert. In the financial sector, fund maturity structure, asset quality and capital structure all had record performances.

--For the complete content, please download the file below