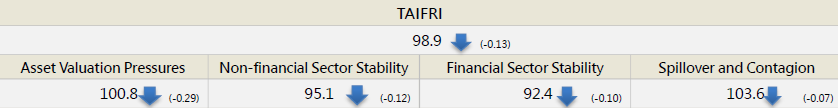

【July TAIFRI Highlights】

-

July TAIFRI index scored 98.9, a further decline from June. The domestic pandemic situation has eased; overall risk is stable

-

Risks in the housing markets eased

In line with government policies, new mortgage approvals have dropped about 65% this year. The pandemic has reduced demand for commercial offices and delayed residential transactions, so real estate prices have been flat, and overall risk declined slightly. In equities, the market P/E ratio fell to a low since July 2019, and risk premiums have risen for 3 months, setting a new high since April 2020, causing an overall decline in stock market risk.

-

Corporate bailouts restarted, banks lend steadily

With the launch of a new bailout plan, corporate financing conditions eased slightly in July, and lending grew. However, because the yield of 10-year bonds fell to a low since February, corporate bond spreads expanded slightly. With the downgrade of the pandemic alert, NPLs should not fluctuate too much. Besides, the average NPL coverage rate pass 650%, and capital adequacy reach a record high, we still have strong and sound banks.

-

Overseas market fear indices rise, investment in overseas high-yield debt continues to make records

Due to weaker growth in the US and China in Q2 and the rise of the Delta variant, fear indices rose from June, especially in China, where stocks fell below their annual line. Continued corporate rescues as the pandemic heats up have eased credit risk in the US, Japan, and Europe, but due to the downgrade of China's Evergrande and SOE defaults, credit risk in Asia ex. Japan has climbed for 5 months. Due to the resurgence, rates are unlikely to be hiked in the short term. Overseas investment in high-yield bond funds has reached more than 10 times that in general bond funds for five months, a new record high since in April 2018.

--For the complete content, please download the file below