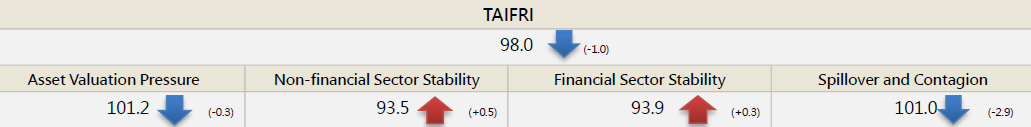

【October TAIFRI Highlights】

-

October TAIFRI scored 98 points, down 1.0 from September, and the lowest since 2020/1

-

Risks in the real estate market are rising, stock market risks are stable, and price volatility is easing

Housing sales prices in Taipei have risen steadily. Rents have also rebounded, but not yet to the level before the outbreak, causing three months of rising risks. Stock market prices increased, risk premiums decreased slightly; equity risk did not change much. TAIWAN VIX reached a new low since 2021/4, indicating stabilization.

-

Contagion risk for domestic financial institutions has declined; international inflation has strengthened expectations of rate hikes and business credit risks

VIX in Taiwan’s major exposure regions declined significantly in October, except for Japan, due to its election. However, inflation has become increasingly visible, causing growth concerns. Credit default insurance has risen in price. International credit default swap indices have risen significantly; Japan reached a new high since 2021/1. In addition, a sharp decline in contagion risk of domestic financial institutions is the main reason for the lower TAIFRI; it is still over 100, yet at the lowest level since 2020/1, showing lower domestic systemic risk.

-

The corporate sector has ample liquidity; high-yield bond fund investments by the household sector have risen again

In the business sector, although rates on BBB debt were the highest since 2021/3, yield on public debt was also the highest since 2020/1, causing a record low spread between the two since the creation of TAIFRI (2007/8). Growth in corporate lending indicates ample liquidity. In the household sector, investment in overseas high-yield bond funds to general bond funds broke 11, a record high since 2018/3. In banking, both the NPL ratio and coverage ratio achieved record performances, but with growing loans, the capital adequacy ratio remains at a historical high of 13-14%, although declining slightly for four consecutive months.

--For the complete content, please download the file below