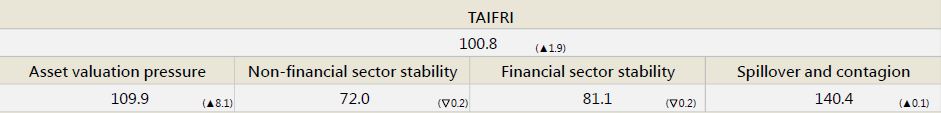

【June TAIFRI Highlights】

-

TAIFRI scored 100.8 in June, up 1.9 from May

-

Real estate market risks moderate; equity volatility rises

In real estate, prices were restrained by a slowdown in transactions, while rents showed a recovery, which slightly cooled market risks. In the stock market, the initial estimate of the June P/E ratio was 10.8, a new low since 2008/12; stock yields reached 8%, a high since 2009/3. However, the VIX of Taiwan stocks hit a new high since 2021/3, indicating higher risk of market volatility.

-

Overseas credit risk and contagion risk continues to rise

CDS indices in Taiwan’s major exposure regions – the US, China, Japan and Europe – continued to rise. Most significantly, in Europe, annual growth rate of credit risk has exceeded 100%, but the volatility index (VIX) receded this month. Japan fell the most, slightly reducing overseas risks. Domestic financial contagion risk has risen for four months, reaching a nine-month high.

-

High-yield bond investments continued to decline

In the household sector, overseas high-yield investment has declined over 2022. High-yield bond fund investments only account for 7 times general bond investments, a low since 2009/9. Spreads between BBB bonds and government bonds declined slightly, annual growth in corporate lending by domestic banks over 2022 has reached 8%-9%, remaining unaffected by rate hikes.

--For the complete content, please download the file below