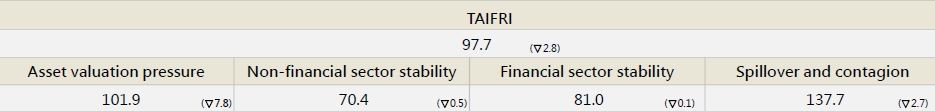

【July TAIFRI Highlights】

-

TAIFRI index scored 97.7 in July, down 2.8 from June

-

Price volatility eased; equity market risks moderated

After reaching a new high since March 2021 in June, with the stabilization of international markets, the VIX of Taiwan equities was significantly reduced in July; overseas high-yield bond fund investment has declined continuously since 2022, and high-yield investment only accounts for an average of 6.5X bond investment, the lowest since 2009 3Q. TWSE's P/E ratio has remained at around 10.8 for two months, during which time the yield has also exceeded 8%. Stock market risk has eased.

-

Overseas market risks and domestic financial market contagion risks have eased

Risks in overseas markets decreased, mainly because the VIX in the US, China, Japan and Europe was down significantly in July from June. Credit risk (CDS) is still rising. In addition, contagion risk in the domestic financial market stopped its 4-month upward trend, indicating lower chances of systemic risks causing chain effects among financial institutions.

-

Bank asset quality and corporate lending continued its momentum

Lending by banks was well controlled. Overall NPL and bad debt coverage ratios performed the best in history, and asset quality remained stable. This year, corporate lending has grown continuously around 8%-9%, with limited impact from rate hikes. In terms of capital structure, average capital adequacy ratios have maintained a very healthy 14%-15% since the beginning of this year.

--For the complete content, please download the file below