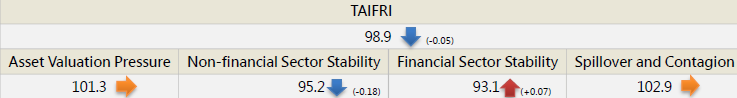

【April TAIFRI Highlights】

-

April TAIFRI Index scored 98.9, down slightly

-

Real estate risks eased, stock market volatility risk recovered

Due to government policies, slightly fewer mortgages were approved in Taipei. The commercial real estate market saw record high transactions and supply shortages in Q1; rents rose. Therefore, risks in both house and office markets declined. In the stock market, P/E ratios have hovered around 20-21 this year, the highest in 8 years, but with low risk-free rates, the stock market risk premium remained at 4-5%. As stocks hit a record in April, profit taking and a resurging pandemic increased volatility from March, increasing risk slightly.

-

Huarong incident in China sharply increased credit risks

Taiwan’s credit risk in international markets except china (US, EU, and Japan) decreased slightly, and overall overseas credit risk was not affected. China’s non-performing asset SOE Huarong was downgraded by Moody’s and Fitch, increasing the credit default swap index in Asia ex. Japan sharply to an 8-month high. Huarong is China’s largest overseas bond issuer.

-

Ratio of overseas high-yield fixed income funds investment reaches record high

The ratio of foreign high-yield fixed income funds investments reached a high since October 2018. The total investment amount of high-yield bonds funds is over 10 times that of general bonds funds. Investors should watch recent increase of overseas credit risk. In the corporate sector, Taiwan’s 10-year government bonds fell by 4 basis points since March, causing the spread on BBB bonds to widen, but the spread since February of 7-8 basis points is the lowest since 2008, indicating abundant funding and low risks.

--For the complete content, please download the file below