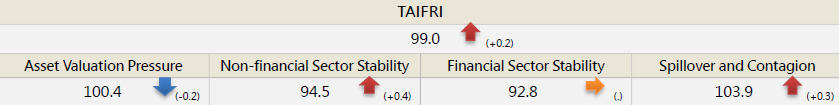

【August TAIFRI Highlights】

-

August TAIFRI scored 99.0; overall risk trends up

-

Increased price-to-rent ratios increase real estate market risk; stock market risk rises slightly

The pandemic and policies have slowed housing market transactions, and mortgage issuance declined significantly. Due to rising construction costs, housing prices remain steady, but rents immediately reflected the decline in economic conditions, causing price-to-rent ratios to rise in August, driving a slight increase in housing risk. P/E ratios and risk premiums of stocks increased slightly. Although Taiwan VIX eased in August, the US Fed will end its loose policy, and global asset price volatility is still high.

-

Credit risk in overseas markets has stabilized; asset price volatility in mainland China have risen

The credit default swap index in Asia ex. Japan has stabilized, but the Chinese real estate developer Evergrande may trigger credit risks due to its large scale and extensive reach. In addition, Chinese asset price volatility jumped to a new high since 2020/6. Contagion risk hasn’t changed significantly, but remains high since the beginning of this year.

-

Risks in the financial and non-financial sectors slow down

Total investment in overseas high-yield bond funds has remained more than 10x the total amount of general bond funds for six months. Stimulus lending has caused strong growth in corporate loans. Bank asset quality and capital structure remain at historical highs.

--For the complete content, please download the file below