Financial Inclusion Education

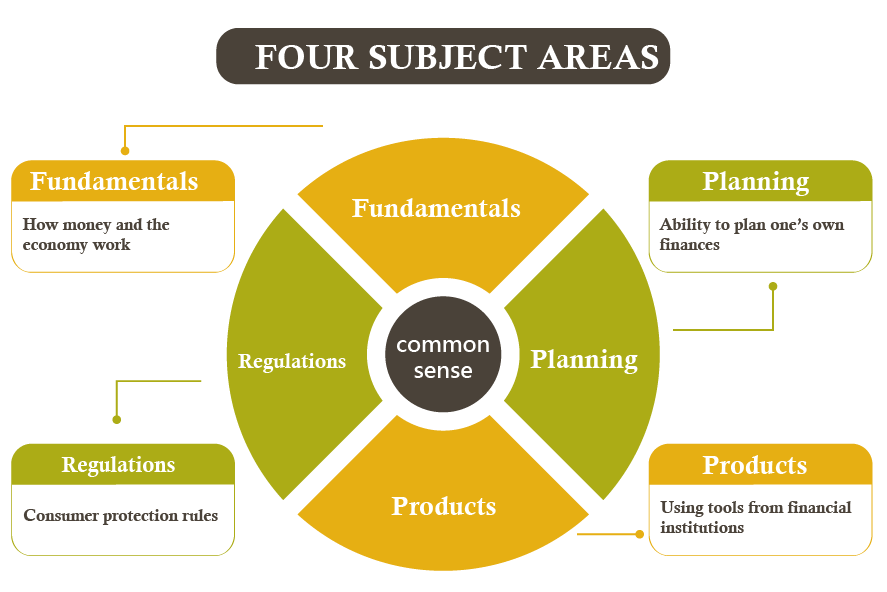

TABF has been deeply involved in Taiwan’s financial education for several decades. In 2019, we started developing a financial inclusion education system based on the Programme for International Student Assessment (PISA) framework developed by the OECD, allowing people of different ages to learn general knowledge to manage their personal finances. The design is based on a survey of the Taiwanese general public on financial proficiency levels, views on financial education, sources of financial knowledge, and topics people wish or need to study. Based on the current state of financial knowledge, four major focus areas were selected.

Materials are presented in well-produced short digital videos, and distributed on digital channels and online social platforms, explaining these topics using examples from everyday life. This digital content is also paired with physical courses and activities, creating an integrated platform for financial inclusion education, policy advocacy and discussion, and advice and suggestions.

Meanwhile, TABF has also developed financial personality and risk resilience tests. After analyzing one’s personal financial status, a financial education model combining training, coaching, and consulting can be used, breaking from the simple instructional model of the past. The trainees are challenged to find possible solutions to their own financial challenges by analyzing their personal situations, setting goals, and then taking effective actions. This model will be implemented in the first batch of rural households in 2020.